It's not just in your head: Anyone who's gone hunting through new or used car dealerships in recent years may have wondered if it was just their area or if cars are getting much more expensive.

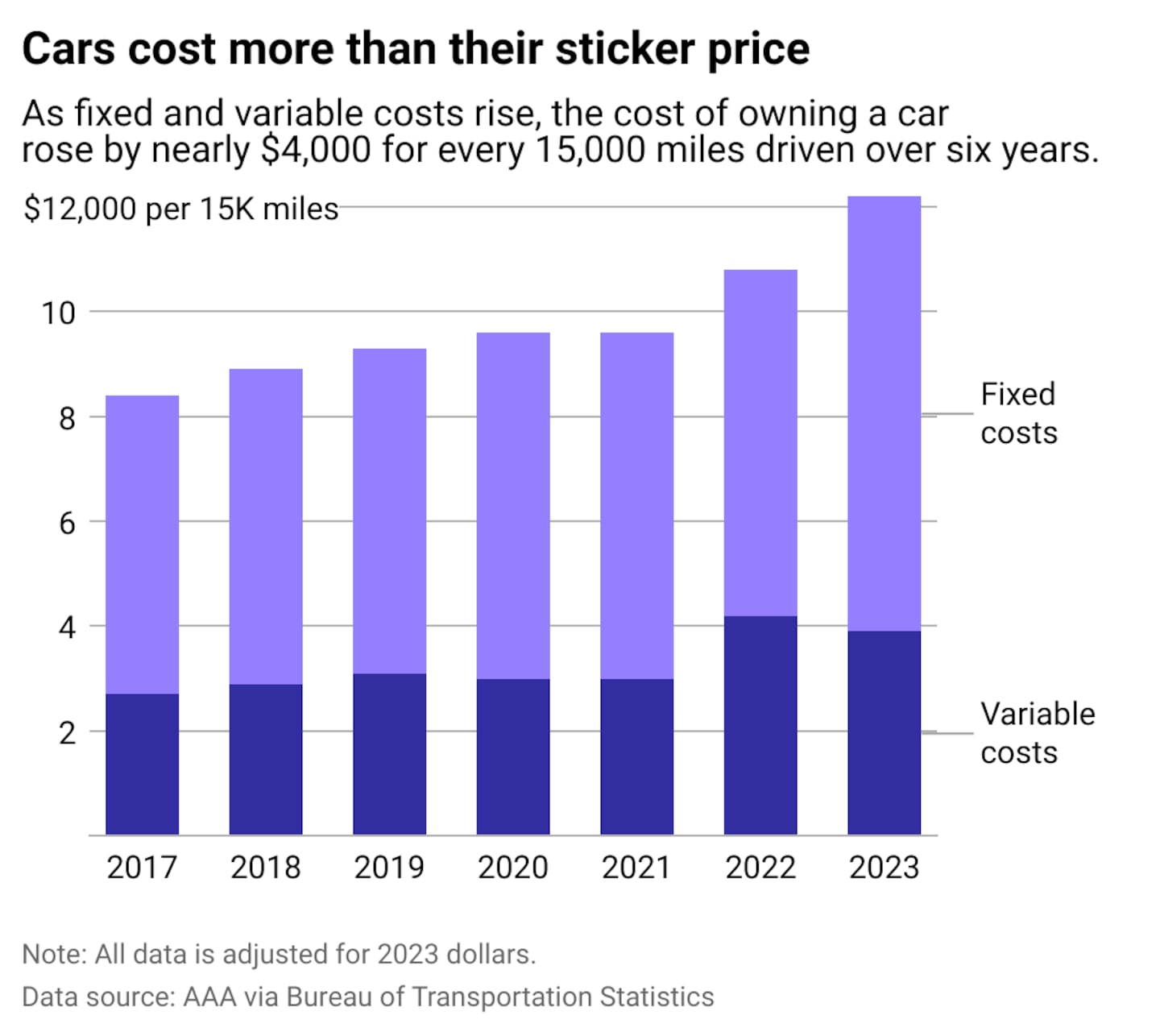

They are, and it's not just because of rising sticker prices. Owning a car today means paying $12,297 a year (or $1,024.71 a month) on average now, according to a 2024 AAA study, up from $10,728 as recently as 2022.

Owning a car includes much more than just the car itself, including fixed and variable costs. Fixed costs may change over time, but whether you drive 100 miles or 10,000 miles a year, you typically pay the same for insurance, license, registration, taxes, and finance fees. Variable costs, on the other hand, will increase the more you use your car, including fuel, maintenance, and tolls.

These prices will also fluctuate depending on your state—just like any cost of living price. "Hidden costs"—gas, repairs, insurance—put the most burden on car owners in Georgia, at an average of $687 a month. Prospective buyers in Alaska, Delaware, Montana, Oregon, and New Hampshire will be happy to know there is no sales tax on cars in their state, with the latter having the least hidden costs in the nation.

While California has the highest per-gallon rate for gas (around $4.66 as of July 2024, according to Bankrate), when the total annual miles driven and tanks emptied are calculated, it's actually those in Indiana that shell out the most for fuel (around $2,913 annually). Unfortunately, a rise in extreme weather events, car crash fatalities, and supply chain shortages means insurance rates are rising nearly everywhere.

The costs of owning a car may be increasingly daunting. Still, for many people—especially those commuting long distances to work or live in rural areas—there's simply no other option. According to Data for Progress, 4 in 5 Americans believe they have no choice but to drive as much as they do.

So many Americans' backs are against the wall. The average person spends 20% of their monthly income on car-related costs, and 16% had to take on a second job just to afford payments, according to a survey of 1,000 drivers by MarketWatch Guides. The same study also revealed that nearly 1 in 6 drivers had to delay maintenance due to finances. It's not surprising, then, that car loan delinquency is at a post-COVID-19 pandemic high.

The General used data from AAA via the Bureau of Transportation Statistics to examine the overall cost of car ownership. From insurance to weather events to protecting unique features, there's a lot more to owning a car than just the vehicle itself.

The General

Owning a car is already expensive

Tariffs

Americans could soon find themselves shouldering the financial burden of diplomatic conflict: In February, President Donald Trump announced a 10% tariff on Chinese imports and a 25% tariff on imports from Canada and Mexico. Considering that the United States is the world's #1 importer of foreign cars (spending $208 billion in 2023, per the Observatory of Economic Complexity), these tariffs can have very real effects on American car owners' everyday vehicle costs.

In 2023, the U.S. imported $44.9 billion worth of vehicles from Mexico and $35 billion from Canada. These new tariffs may increase repair costs for cars from these countries by a hundred dollars or more; the average price of a vehicle imported from Mexico or Canada could rise an additional $6,250, according to S&P Global Mobility.

Insurance

The U.S. has had a rough year regarding natural disasters: 2024 alone saw a near-record 27 weather and climate events that racked up $1 billion in damages across the U.S.

How does that relate to car ownership? Unsurprisingly, insurance costs will be more expensive in states susceptible to natural disasters, including coastal areas and those prone to tornadoes, hurricanes, and blizzards. From 2023 to 2024, for example, auto insurance rates rose by 43% in New Jersey, 30% in Florida, 37% in Georgia, and 57% in Missouri.

In the face of rising storm-related damage, consumers should also consider different kinds of insurance, which can affect what they pay out of pocket. For instance, comprehensive coverage—which is often optional when purchasing auto insurance—can cover damage that you would otherwise pay out of pocket, including damage from storms, floods, earthquakes, and falling trees.

Besides comprehensive coverage, many other types of auto insurance add-ons can keep car owners from having to pay for cripplingly expensive damage themselves. These include property damage liability (which covers the damage you may cause to someone else's property if you hit it with your car), collision coverage (which covers damage to your own car if you hit another car or object), and personal injury protection (which covers injuries you or your passengers might sustain in an accident).

The bottom line? It's not just damage to your car that you have to worry about—and having more than one insurance policy might save you money in the long run.

Special features

As a new variety of cars is rising, their unique features may pose higher price tags when they malfunction and need repair. For instance, automatic brakes and cameras are much more complicated, expensive, and time-consuming to fix. Additionally, modern cars are built out of more advanced materials, including aluminum, magnesium alloys, and high-strength steel. All of these aspects can hike up your repair costs.

Electric vehicles are also particularly costly to repair: At the start of 2024, the average repair bill for an EV in the U.S. was 29% higher than that of a regular vehicle (around $6,0666, based on insurance data from Mitchell). That's mainly because it takes more hours to repair an EV's more complicated internal wiring: the average number of hours used to repair an EV is about twice that of a regular car. Since the average hourly rate for a mechanic in the U.S. is over $100, that adds up fast.

Labor costs

As cars get more sophisticated, the labor involved in constructing them gets more complicated—and expensive.

Unfortunately, there's currently a labor shortage for mechanics in the U.S., which is contributing to higher costs for manufacturing and repairing vehicles. From 2023 to 2024, there was a gap of nearly 40,000 car technicians in the country, according to TechForce Foundation's 2024 Supply & Demand Report.

At the same time, many automobile workers are striking for higher wages, which also means a larger price tag for shoppers. In 2023, GM, Ford, and Stellantis workers were granted a salary increase of 25%; Volkswagen and Honda quickly followed suit with 11% raises; then Toyota with 9%; and Hyundai with 25% over the next four years.

Given these factors that contribute to increased costs, one would think car purchases would be less enticing, but surprisingly, just 8% of drivers expressed regret, according to the MarketWatch survey. Some have also taken a stoic outlook, employing strategies to stay on track with their finances, such as paying loans off early, taking public transit when possible, and attempting repairs themselves.

While there are many reasons for costs to rise, budgeting wisely and making informed choices are two ways owners can stay on the road without overburdening their pockets.

Story editing by Carren Jao. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on The General and was produced and distributed in partnership with Stacker Studio.