Despite a generally positive economic outlook, many Americans are feeling the pinch in their wallets every time they fill up their tank, buy groceries, or pay their rent.

The reality is that maintaining financial stability is a pressing problem for many Americans. Yet the numbers tell a different story. The difference between how people feel about their financial wellness and what the numbers say they should feel about their income and expenses depends on who you ask.

First, consider the data: After years of rising inflation, price growth began to slow by the end of 2024; however, the cost of goods and services remained high—up 2.7% compared to the year before. In November 2024, grocery prices rose by 0.5% from the month before, though this varies across food groups. For example, during that same period, the cost of cereal and baked goods fell by 1.1%, while eggs rose 8%. This jump in egg prices pushed the average cost to $3.65, an increase of more than $1.50 from the previous year.

Housing prices have also caused financial hardships. In November, housing costs increased at the slowest level since 2021, but they're still about 5% higher than the previous year, according to the Labor Department.

As Americans spend a larger portion of their paychecks on food and shelter, it's taking a psychological toll. A June 2024 report from the American Psychological Association found that most men and women are concerned their salaries are not keeping up with inflation.

However, economic data shows workers' earnings rose about 4% from the end of 2023 to the third quarter of 2024, nearly 1.5% more than prices. So what's behind the disconnect between wage growth and feelings of uncertainty—and how can both be true?

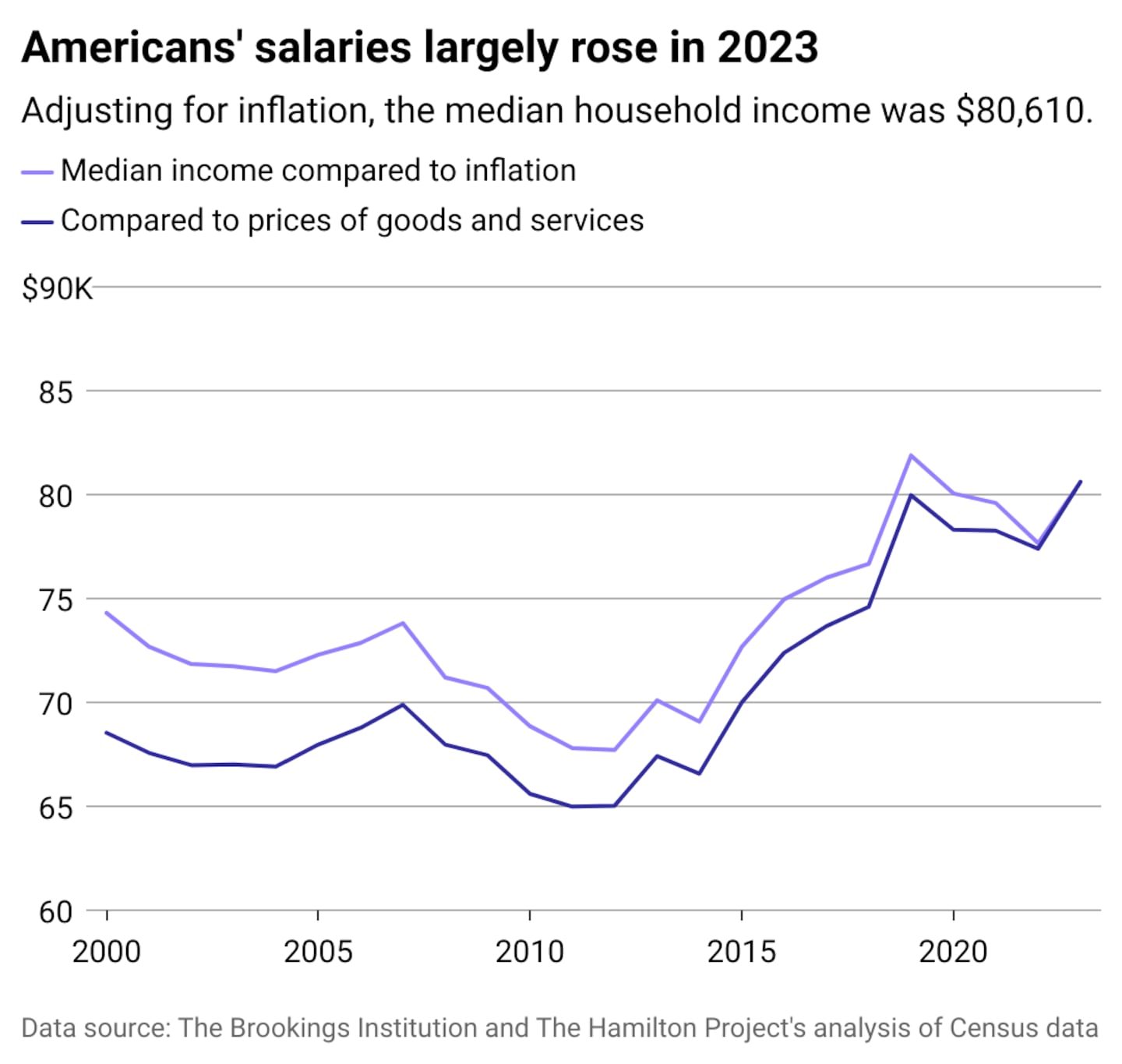

Wealth Enhancement examined pay data and analysis from the nonprofit Brookings Institution to determine why Americans feel wages are not increasing with inflation.

Wealth Enhancement

How economists measure wage growth

There are several metrics economists use to compare wages to inflation.

The most common inflation metric is the Consumer Price Index, which measures daily living expenses and compares the price of certain goods and services over time. Personal consumption expenditures, meanwhile, look at how much Americans are actually spending. While both have similar goals, the results can vary, depending on how you slice it.

For example, the typical cost of public transit (which includes airfare, train tickets, and bus passes) is about 7% higher than the year before, according to the Labor Department. However, the amount Americans spent on these services fell about 8% over the same time, according to the Bureau of Economic Analysis. In other words, commutes may cost more, but since fewer people commute, they spend less money on average.

That's where wages come in. Using both measurements, the typical household earned more than $80,000 in 2023, according to analysis from the Brookings Institution and The Hamilton Project. That's a big jump from 2020, when the median household income was $68,000.

So why are so many Americans experiencing economic instability? Because everyone's situation is different and people get paid differently, there are different ways to calculate "real pay," or how much an individual makes after adjusting for inflation.

Looking at the average hourly or weekly wages, economists divide the total amount of money people bring home by the number of people working. However, this can be misleading.

For example, wages appeared to rise during the COVID-19 pandemic, but that was mainly because people with lower wages were more likely to be laid off. In other words, the people who remained employed during the pandemic were more likely to have high salaries. And since people with low-wage jobs were unemployed, they were no longer part of the denominator when determining the typical income of all Americans in the workforce.

Since then, the labor market has tightened, and wages have increased across all income levels. The biggest gains were among the bottom 10 percent of earners, whose real wages grew by 13% from 2019 to 2023, according to a 2024 Economic Policy Institute report. Still, even as some states have worked to increase the minimum wage, it hasn't been enough to make up for decades of stagnant wage growth among low-income workers, who continue to struggle to make ends meet. Nationwide, Census data shows that nearly half of renters are considered rent-burdened, meaning more than 30% of their income goes toward housing.

Another way to measure workers' earnings is the Employment Cost Index, which measures companies' employee spending. It includes the amount employers pay in wages and salaries and the cost of benefits, which is important for long-term planning but may not be felt directly in people's paychecks.

In September 2024, for instance, wages had grown 3.9% from the previous year, while the cost of benefits rose 3.7%.

That's why the data on its face can be misleading, and closer examination is necessary.

Photo illustration by Elizabeth Ciano // Stacker // Shutterstock

What to expect in 2025

Looking ahead, economists project inflation will continue to slow in 2025. In a November 2024 report, Goldman Sachs Research estimated the U.S. gross domestic product would grow 2.5%, while personal consumption would shrink to 2.1%. However, researchers at the global investment bank say if and when the Trump administration implements tariffs, inflation could rise to 2.4%.

These are all key metrics observed by the Federal Reserve, which determines short-term interest rates to maximize employment and stabilize prices. At its December 2024 meeting, the central bank said it expects to cut interest rates twice in 2025 as the economy strengthens and unemployment rates fall.

Wages are also projected to rise in 2025, though not as much as they did in 2024. A poll of 1,550 organizations that utilize pay services company Payscale found that employers plan to give workers a 3.5% raise this year as inflation is expected to stabilize and companies cut back on hiring.

In the end, while some Americans will take home more pay in 2025, others could be left behind. Geopolitical uncertainty, policy changes, and action from the Federal Reserve could cause the costs of certain goods and services to continue rising in the months ahead.

Story editing by Alizah Salario. Additional editing by Elisa Huang. Copy editing by Paris Close.

This story originally appeared on Wealth Enhancement and was produced and distributed in partnership with Stacker Studio.