As Southern California still reels from January's catastrophic wildfires, the economic damage has surged to $250 billion, far exceeding initial estimates. But that figure doesn't account for damage incurred by residents whose homes and businesses were reduced to rubble and ash.

The Palisades and Eaton fires alone will result in up to $45 billion in insurance payouts to homeowners and businesses, according to data analytics firm CoreLogic. Of course, that only applies to residents who had insurance in the first place.

In the wake of an extreme weather event, residents typically can rely on insurance claims to repair damaged property —but the increasing frequency and severity of fires, storms, floods, and other occurrences complicate coverage.

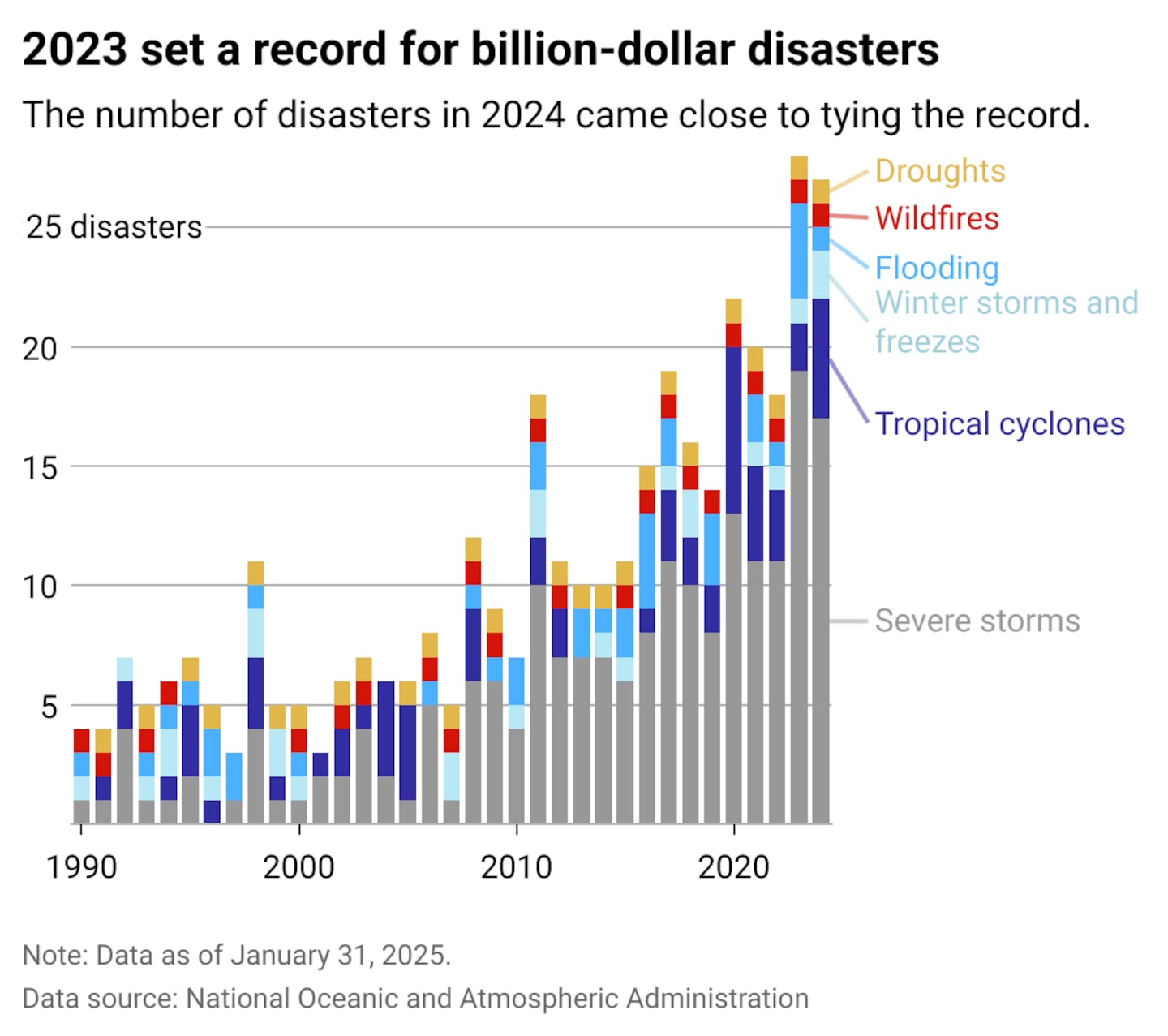

The National Oceanic and Atmospheric Administration in 2023 documented 28 separate billion-dollar climate and weather disasters across the U.S., a number that outpaced any prior year on record. Climate change is the main culprit fueling these disasters' increasing frequency and intensity. By September 2023, NOAA reported that the U.S. had already racked up a staggering $57.6 billion in damages for that year.

Insurance companies have responded with higher rates to cover costs, culminating in overall higher insurance fees for customers. In June, the Bipartisan Policy Center reported that property insurance rates have increased every quarter since the end of 2017. And car insurance isn't faring any better, either: According to the Washington Post, blizzards, tornadoes, and hailstorms led to a 52% increase in auto insurance premiums in Colorado from 2013 to 2023, and hurricanes are responsible for an 88% jump in Florida over the same period.

CheapInsurance.com used data from NOAA to analyze the rising number of billion-dollar disasters and their implications for the insurance marketplace in the U.S.

Some insurers have begun leaving states altogether to ensure profit margins, particularly in coastal areas. Notably, Allstate and State Farm halted new policy sales in 2023 for property and casualty coverage in California due to wildfire costs. Many insurers have abandoned Louisiana and Florida residents as hurricane risk intensifies.

Annual home insurance rates average $2,258 as of February 2025—a slight dip from last year. Costs vary widely based on a home's size, age, and location. Nebraska, Florida, and Oklahoma have the highest rates in the nation.

CheapInsurance.com

Severe storms cause the most damage nationally each year

Droughts, storms, and floods were nearly unrelenting throughout 2023. In August, Hurricane Idalia brought storm surge, heavy rains, and flooding to Florida, Georgia, and the Carolinas, causing $3.5 billion in damages. 2024 didn't offer much of a break, either. The year began with tornadoes and high winds across the entire East Coast, racking up $1.8 billion in damages, and ended with back-to-back catastrophic hurricanes, Helene and Milton. Together, they caused an estimated $300 billion in damages and killed 250 people in Florida and other southeastern states.

With severe weather disasters becoming more common, the market for insurance has become more limited—especially in disaster-prone states. In Florida and California, for instance, some big-name insurers have stopped providing services altogether. To counter this, Florida implemented the Hurricane Catastrophe Fund and Citizens Property Insurance Corporation, both of which subsidize home insurance.

California, on the other hand, regulates insurer rates by only allowing them to evaluate based on the past 20 years, not just the current conditions. Both methods are imperfect: Florida's subsidy funds are draining quickly, and many insurers refuse to operate in California.

It's important to note that insurance alone is just treating the symptom of a larger issue: In addition to reevaluating home and auto insurance policies, states need to examine how they brace for—and recover from—natural disasters overall. As storms grow and insurance vanishes, they can't afford not to.

A mutually beneficial option might be for insurers and clients to engage in more transparent negotiations. In wildfire-riddled Oregon, for example, new legislation is attempting to encourage insurers to work with citizens to identify and increase coverage for mitigation measures.

Story editing by Nicole Caldwell and Alizah Salario. Additional editing by Kelly Glass and Elisa Huang. Copy editing by Tim Bruns and Kristen Wegrzyn.

This story originally appeared on CheapInsurance.com and was produced and distributed in partnership with Stacker Studio.