In an uncertain economy fueled by high interest rates, annuities are more popular than ever. Last year, annuity sales soared to a record-high $385.4 billion in the U.S., a whopping 23% increase over the year before.

However, roughly four out of five American adults (79%) still struggle to identify the correct definition of an annuity, according to the 2024 Policygenius Annuities Literacy Survey.

Key findings:

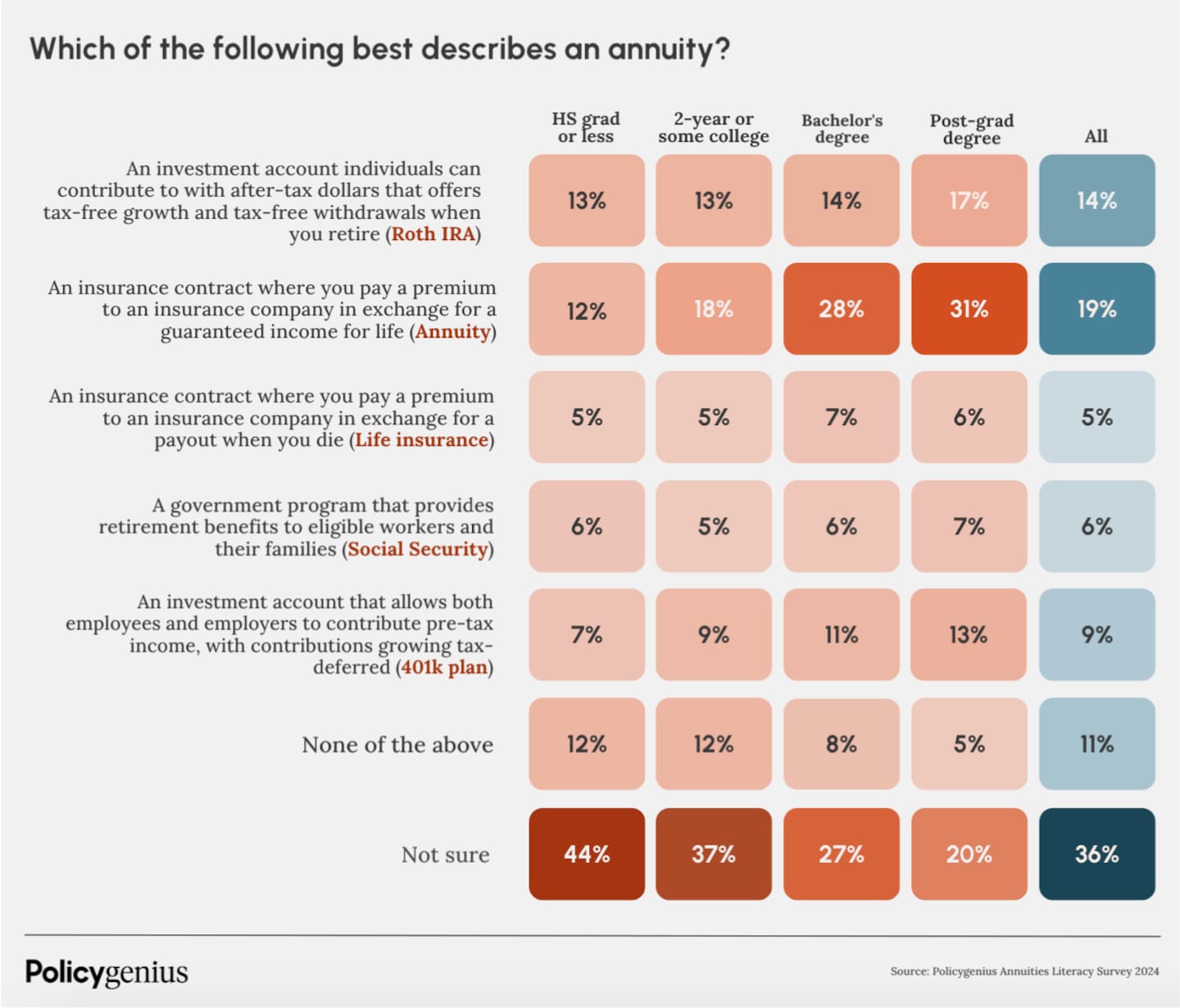

- Only 19% of American adults are able to identify the correct definition of an annuity.

- Less than three in 10 (28%) American adults with four-year college degrees are able to identify the correct definition of an annuity.

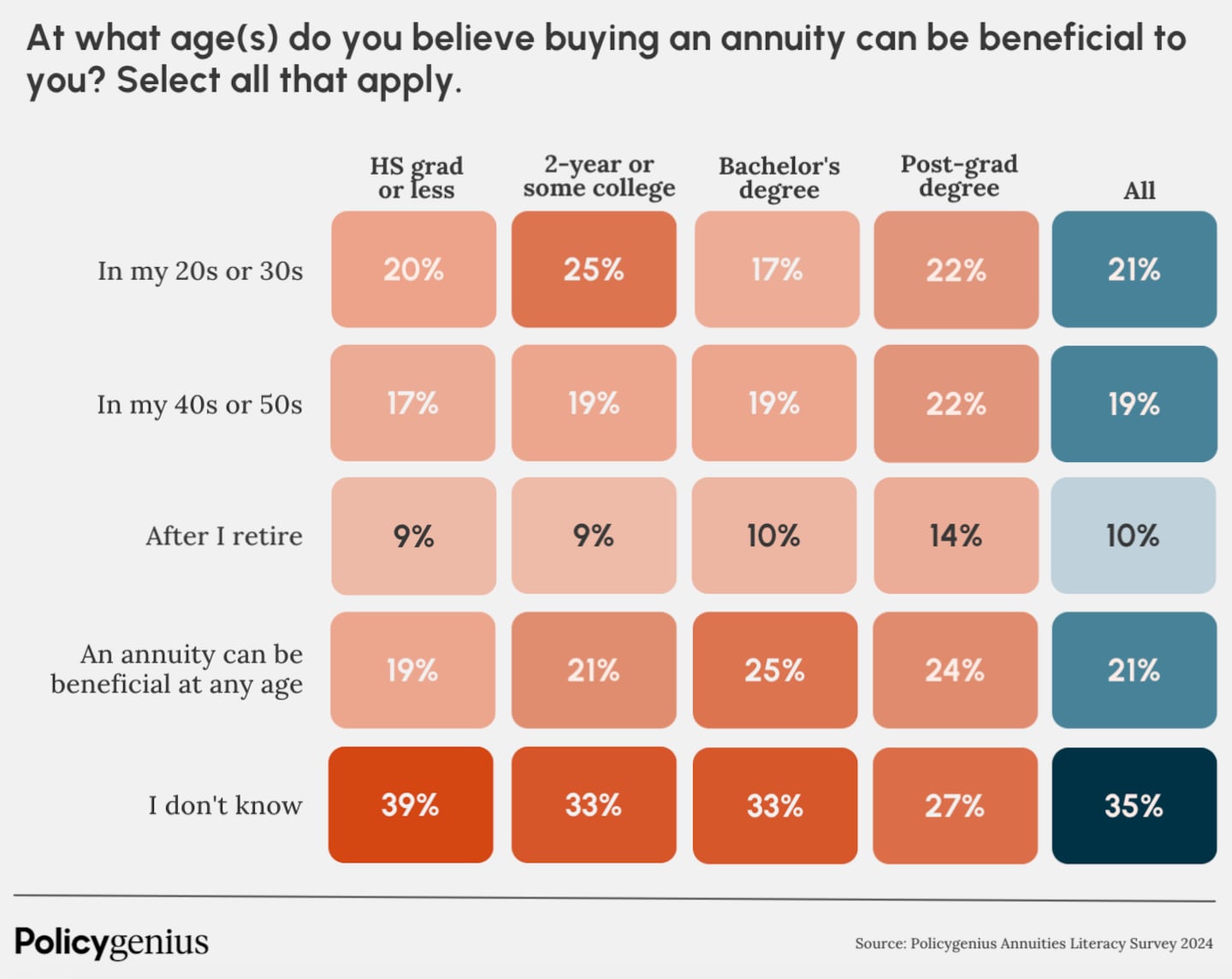

- Over a third of American adults (35%) don't know when buying an annuity could benefit them.

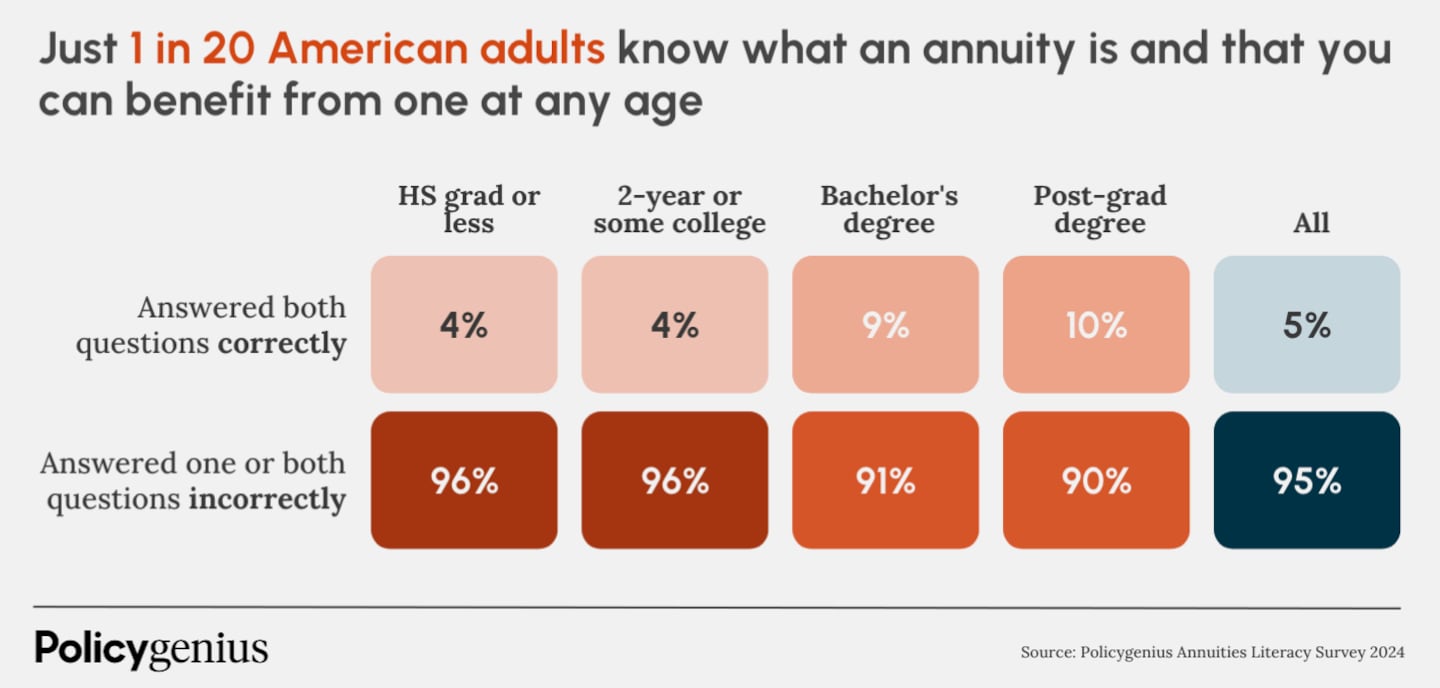

- Only 5% of American adults are able to both identify the correct definition of an annuity and accurately indicate at what age using an annuity could benefit them.

Policygenius

Many Americans Are Confused About Annuities—and Other Financial Tools

Annuities are insurance contracts that provide a guaranteed stream of income, most often for life. Many people use annuities to offset the risk of outliving their savings, or to supplement their income later in life, usually after they retire.

But unlike other financial products that have also become popular in recent years, such as credit card rewards and even cryptocurrency, annuities are complex — it can be hard to pick the right contract without the guidance of a financial advisor.

Just 16% of Americans aged 35 to 54 were able to correctly define an annuity. Older adults were more likely to know what an annuity is, but only one in four Americans aged 55 and up identified the correct definition in the survey.

Further, college-educated Americans are twice as likely to know how an annuity works than participants with a lower level of education (29% of those with a four-year degree or more vs. 14% of those with some college or less), according to the survey.

Still, almost three in 10 (29%) with four-year degrees or more were able to identify the correct definition of an annuity — compared to 14% with some college or a two-year degree, or less.

These results suggest annuities aren't the only financial tool that American adults are confused about. Roughly one in three (34%) U.S. adults mistook annuity contracts for other products like IRAs, 401(k) plans, or even life insurance policies.

In fact, 14% of all respondents matched an annuity to the definition of a Roth IRA. Further, 9% of all respondents matched an annuity to the definition of a 401(k) plan. And 17% and 13% of adults with a postgraduate degree matched the definition of an annuity to a Roth IRA or 401(k), respectively.

Annuities Can Be a Good Financial Fit at Any Age, But Most Americans Aren't Aware

While annuities are often used to complement a retirement strategy, an annuity can be beneficial at any age, depending on the individual's financial situation and goals. However, only about one in five (21%) U.S. adults knew this, and about 35% of respondents weren't sure when using an annuity could be beneficial.

Education level didn't make much of a difference here — participants with four years of college education or graduate studies were only about 20% more likely than participants with a lower level of education to know that annuities can be a good financial asset at any point in life.

Policygenius

Only 5% of American Adults Know How Annuities Work and That They Can Be Beneficial at Any Age

Very few Americans were able to identify the correct definition of an annuity, as well as recognize that an annuity can be beneficial at any age. Roughly one in 10 of adults with a four-year (9%) or postgraduate (10%) degree were able to answer both questions correctly.

"Annuities are fairly difficult because they're so complex — you can't even have the same advisor selling you multiple types of annuities" because some contracts, like variable annuities, are considered securities that involve SEC regulations, says Steven J. Lee, Ph.D, CFJ, and finance lecturer at Cal Poly Pomona, who was unsurprised at the findings from the Policygenius survey. They're "a complex product that's being sold in a very complex regulatory environment."

Policygenius

Challenges in Categorizing and Educating Consumers on Annuities

The push for more comprehensive personal finance education has increased in recent years. The Council for Economic Education cited that in 2024, two-thirds of states now include a personal finance class as a high school graduation requirement, up from 2022, when fewer than half of states had a similar guideline in place.

Lee explains how, even at the college level, it's difficult to categorize annuities in a personal finance curriculum due to their complexity. Do they go under investments? Budgeting? Retirement?

Couple that with the fact that "there's no streamlined education process" for financial advisors in the U.S., so "annuities are caught in the crosshairs" between different schools of thought within the financial advisor community, Lee says.

For instance, Lee advises to be wary of Assets Under Management companies that denounce annuities because of the fees that come with them (often 1% or 1.5%, sometimes lower or higher depending on the specific type of contract). "But then when you look at the client statements for those firms, they're charging 1% to 1.5% per year in fees a lot of times — it's crazy."

This ongoing discourse makes it difficult to explain some financial products and services to consumers in a logical, clear way. After professionals reach a consensus on best practices for education on annuities, "now we need to figure out a way to transmit the knowledge to the public," Lee says.

How to Add an Annuity to Your Financial Plan

Even once you have a basic understanding of what annuities are and how they work, "you need someone who is dedicated to the deep knowledge of the products specifically," Lee explains.

In terms of finding an agent or advisor you trust, Lee recommends first verifying their credentials with their state department of insurance and FINRA, depending on their advisory licenses.

Then, if you're considering purchasing an annuity, Lee recommends asking the following questions:

- What are the fees?

- How long is the surrender period?

- What is the surrender charge?

- How long is my money tied up?

- What is the financial strength of the insurance company?

Annuities are complex, but it's worth doing your homework if they add value to your financial plan.

"When used properly, in the right context, [annuities] are amazing," Lee says. "They can be used to solve a lot of problems. They can also be weaponized to cause a lot of problems." Most other financial products don't have that kind of extreme spectrum, but annuities do, "just because that's the nature of annuities and the nature of the regulatory landscape."

Methodology

Policygenius commissioned YouGov to poll 2,353 Americans 18 or older. The survey was carried out online from April 25 through April 29, 2024. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 2%.

This story was produced by Policygenius and reviewed and distributed by Stacker.